April 29, 2025

April 29, 2025

Sujata, an employee of a company featured in the Economic Times list of top companies, was surprised to receive offers for a Credit Card and Personal Loan just three months after she started working there. The offers came from ICICI Bank, with which she had her corporate salary account, and other prominent banks, such as HDFC Bank and AXIS Bank, and she was spoilt for choice.

For employees at companies classified as Category A or B in the HDFC Bank Company Category List, such as Sujata’s, these privileges are not just surprising, but also a testament to the benefits of working for a listed company. In contrast, applicants from Category C or D companies are not offered similar privileges, highlighting the advantages of being associated with a top-tier company.

Let us look into why Banks are ready to offer Personal Loans and Credit Cards to the employees of companies included in the approved list for sourcing.

Data analysis has shown that applicants working for listed companies are less likely to delay or default on their payments, making them the preferred segment for lending, particularly for unsecured Personal Loans and Credit Cards.

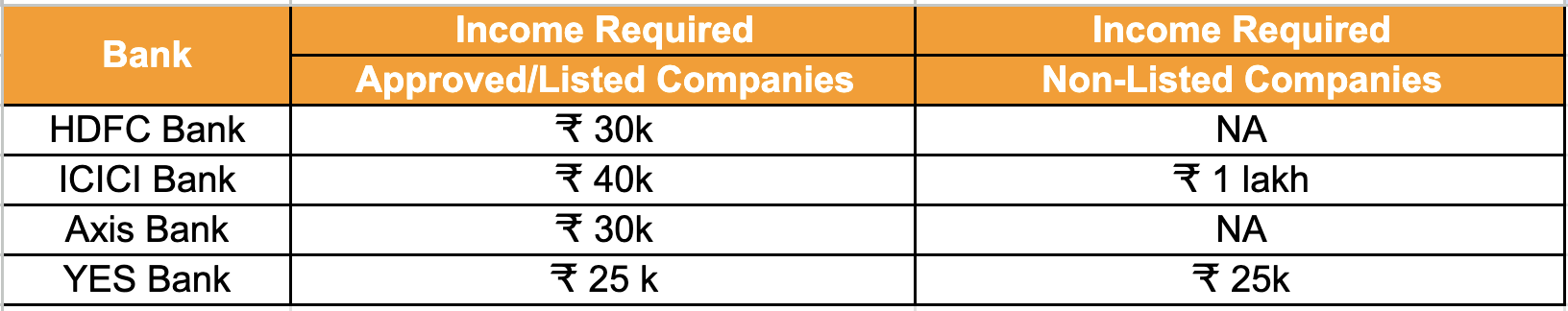

Income: Banks and NBFCS issue credit based on monthly income and the customer’s profile. Banks have an individual policy of a minimum salary requirement for issuing credit for lifestyle needs, such as Credit Cards and Personal Loans. Listed Company employees are favoured and entertained with a lower salary transfer. Some Banks restrict sourcing and require a higher income for Non-Listed Company Applicants.

Tenure: A Personal Loan’s tenure or repayment term is between 12 and 72 months. The bank sets the repayment term at the time of loan disbursal, and it remains fixed. Applicants from listed companies are granted a longer repayment tenure of 72 or even 84 months. In contrast, the term for applicants working in Category C or D companies is limited to 48 or 60 months.

Loan Amount and Credit Card Limit: Banks provide Personal Loans ranging from ₹ 1 Lakh to 40 Lakh, depending on the customer’s needs, monthly income, and repayment capacity. According to the bank’s eligibility criteria, the loan amount issued to applicants employed with listed companies is the maximum, as there is a cap on the loan amount for applicants employed with non-listed companies.

Similarly, for Credit Cards, the credit limit issued for an applicant working in an Economic Times-listed company will be higher than that of a private limited company not featured on the list.

Experience: Most banks require a minimum of one year of work experience to process a Personal Loan or a Credit Card. However, an exception is made for applicants working in the Approved Company Category List of Banks individuals employed with elite or super prime companies earning a monthly salary of ₹50,000 and above can apply with a continuity of three months or more.

However, customers employed by Non-Listed Companies are eligible for unsecured credit, although eligibility standards and lenders’ options are limited. If you work for a company not on the approved list of major banks, securing a personal loan or credit from banks that provide credit to non-listed companies, such as YES Bank and IndusInd Bank, is possible. There are key factors to keep in mind that will help secure credit.

Income: Banks ask for higher salary credits from non-listed company applicants. High-income applicants with a monthly salary of ₹ 1 Lakh and above are treated in a preferred category and are issued Credit Cards and Personal Loans despite working for an unlisted firm.

Stability: Applicants who own or have a family-owned residence and work with a government organisation are considered stable and financially eligible for unsecured credit if the lender’s other Eligibility Criteria are fulfilled.

The CIBIL Score requirement of 730 to 750 has become mandatory for a Credit Card or a Personal Loan. Applicants with a high CIBIL Score and a sound repayment track of existing credit are liable to be given credit readily when needed.

Having a successful financial relationship with a Bank and maintaining an account with a healthy balance at all times can significantly boost a credit application. This empowers the audience to take control of their financial health and be favorably viewed by lenders.

Company Turnover: The performance of the company the applicant is applying to is reviewed if the company is not listed in the AXIS Bank Company Category List, but the applicant has an account, and privileges of a Credit Card or a Personal Loan are awarded.

In conclusion, banks look for borrowers confident they will return the funds on time. As unsecured funds come without security, borrowers with secure backgrounds are preferred.

Companies in the approved list of banks are added after their profit margins and turnovers are constantly checked and verified. Organisations predicted to face a downturn, such as the travel industry, are delisted during COVID-19.

As the turnaround for Personal Loans is shorter and debt recovery is a mammoth task, Banks are reassured to extend credit to salaried employees of thriving companies. These employees are assured of receiving their salaries and can, in turn, pay their dues on time.

Our Related Searches:-

Personal Loan for Non-Listed Companies in India, Personal Loan for Employees of Non-Categorized Companies, Personal Loan for Proprietorship or Non-listed Companies, Personal Loans for Unlisted Company Employees in India, Personal Loan for Corporate Employees, Personal Loan for Employees of Non-Listed Companies, Personal Loans for listed Companies in India.