July 14, 2016

July 14, 2016

In an earlier blog we covered extensively about the Credit Information Bureau (India) Limited which collects and maintains records of an individual’s payments pertaining to loans and credit cards.

Your Loan Application is heavily dependent on the Credit Score. A lower score will result in a higher probability of Your Loan Application being rejected. An applicant should access your score at least once a year to understand your position and further redeem your Credit Score, if it’s not satisfactory.

While there are many factors which impact your CIBIL Score directly or indirectly, the most important factor remains your payment history. On time payments result in a good score while defaulters results in your score significantly dropping. Other factors include your credit utilization history which should be below 30% at all times. History of loan rejections also plays an important emulating tool.

On Time Payments: Since this result in making up 35% of your credit score, it is important not to be a defaulter and ensuring all dues are cleared within the set timelines.

Mix of Secured and Unsecured Loans: A factor that helps you attain a high CIBIL Score is a good balance of secured and unsecured credit. Unsecured credits are not secured by collateral. This means they are not directly connected to property that a lender can seize if the individual fails to pay. Even having only credit cards and Personal Loans is considered a definite score dropper.

Number of Inquiries: Avoid too many inquires as it catches attention of the lender. Each inquiry results in a drop of 5-10 points from your overall score.

Credit Age Limit: If you have been servicing debt for a longer period of time and handling it responsibly, it is going to have a positive impact on your score.

In case you have been a defaulter with your payments, then chalk out a plan. Study your finances immediately and ensure you start paying your dues on time. On the other hand, if you have an impeccable record with your payments and loan history then you need to examine the records carefully and address the dispute with immediate effect. Sometimes records are not updated by lenders and need to be brought to their notice.

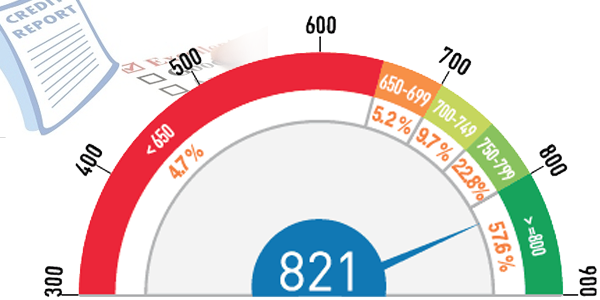

While the mentioned above factors are by large common, it is important to remember that every profile is different and showcases different patterns and behavior. The score is calculated based on the person’s credit profile parameters at that point in time. Keeping a healthy score of above 750-800 is vital to ensure that your loan will be sanctioned. Another word of caution is, having low credit utilization is good for your credit score, but having no credit utilization is bad for your Credit Score.